SALES TAX & EXEMPTIONS

Sales Tax Policy: Bulk Bookstore is required by state laws to have your sales tax exempt certificate to process your order without tax. If we do not have your certificate on file, when your order is placed, you will be charged tax.

New Customers

If your organization is tax exempt, there are just two simple steps to follow before you order for the first time:

Place Your Order

Existing Customers

If you haven't already, please follow these steps to make sure your organization has been properly qualified with us as exempt from state sales taxes.

Save your login credentials. Your account will be set as non-taxable and all future purchases using this account will be tax exempt.

Checkout

Each state has its own set of exemption certificates as well as rules and regulations covering their use. In order for an organization to be exempt, the organization must apply for, and be granted, exempt sales and use tax status in the state(s) in which they conduct business. To learn more about your state's requirements, simply search online for "Sales Tax Exemption in.... (the state where you are planning to ship books)", or click here for a list of forms and links available.

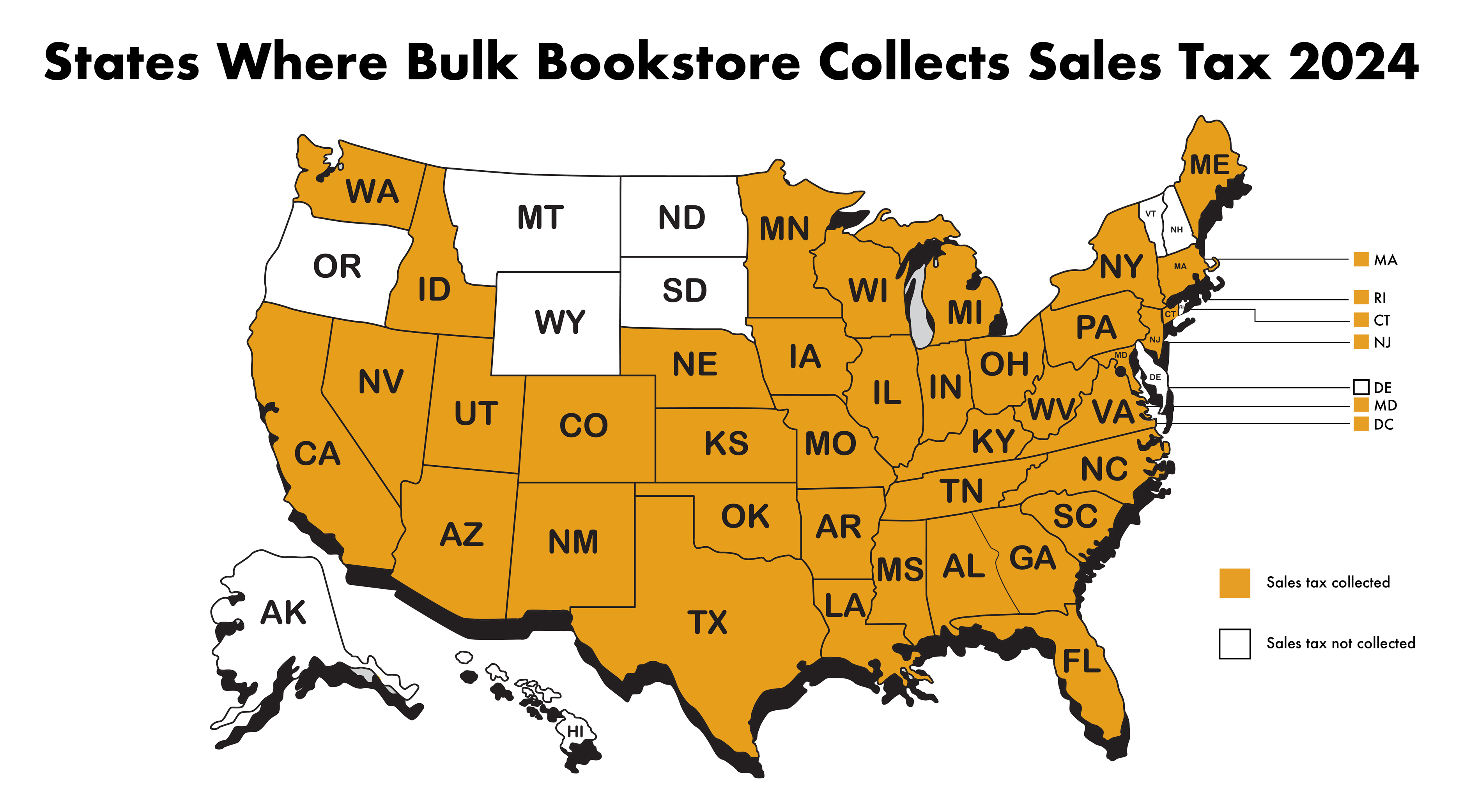

States Where Bulk Bookstore Collects Sales Tax